improvements and betterments

Hi, welcome to solsarin site, today we want to talk about“improvements and betterments”,

thank you for choosing us.

improvements and betterments

Improvements and betterments are often enhancements that increase the value of the property and become a permanent part of the building. These include changes in the structure, flooring, ceilings, appliances, built-in shelves, bookcases, and more. Because these changes can increase the value of the

property, they create a value that can and should be replaced if damage to the property occurs in the future.

Suppose that a landlord leases a storefront to a retailer that makes improvements to the facility by adding features to help sell its products. During the lease, a fire breaks out and damages the building, including the features added by the retailer to improve the space.

- Who did the improvements belong to?

- Who is responsible for paying the damages?

Defining Improvements and Betterments

While legal definitions vary, improvements and betterments are anything that a tenant attaches to the landlord’s real estate that becomes a permanent part of that real estate. Under most leases, such improvements become the property of the landlord and tenants are responsible for repairing or replacing the improvements in the event of loss. However, property policies can be customized to

determine whether tenants’ improvements and betterments are covered under the building category or under the contents category.

What is Improvements and Betterments Insurance?

Improvements and betterments insurance refers to a policy that a tenant can obtain when renting property to cover any modifications to the property. This is a policy separate from the landlord’s property insurance. Improvements and Betterments typically increase the value of a property,

meaning additional insurance should be added to cover the difference. To learn more about the difference between renter’s insurance, business insurance and improvements and betterments insurance, contact H&K Insurance with any questions.

Understanding Betterment Insurance

An entity leasing a building may purchase betterment insurance to protect the company, should they lose access to the use of modifications they made to the structure.moreover, Most businesses that lease space or a building may wish to make changes to fit their business concept and employee needs. In some cases, these modifications are temporary and can be easily removed or replaced if the business should lose access to the rented space or it becomes damaged.

Where Do You Buy Improvements and Betterments Insurance Coverage?

Improvements and Betterments coverage may be written as either separate insurance or as part of the coverage on personal property in CP 00 10-Building and Personal Property Coverage Form.

Improvements and betterments insurance coverage covers the insured’s use of and interest in improvements and betterments made or added to a leased building.

Loss Valuation

When arranging loss recovery on an unamortized basis, the recovery is based on a proportion of the original cost of installing the improvements and betterments. For example, the insured tenant makes alterations or improvements and must spend $5,000 to remove a portion of the existing building to make the changes. It then installs the improvements valued at $10,000. This coverage enables the tenant to recover an insured loss based on the entire $15,000 installation investment. Recovery on this basis makes the insured whole and also enables it to properly amortize the entire investment, including the $5,000 wrecking or tearing-out expense.

However, if the insured tenant actually replaces the damaged improvements, the form properly limits it to the actual cash value of the damaged improvements. This is because it would then be necessary to restore the improvements themselves and not again incur the expense of tearing out any portion of the building. In some cases, and for these reasons, the original cost may exceed the actual cash value.

Improvements and betterments coverage is subject to coinsurance.

Loss Valuation

These repairs must be made promptly. moreover, This proportion is calculated as follows:

- Determine the original cost of the damaged improvement and betterments.

- Determine the number of days from the date of loss to the expiration date of the lease or the expiration of any lease renewal option.

- Multiply Step 1 by Step 2.

- Determine the number of days from the date that the damaged improvements and betterments were installed to the expiration date of the lease or the expiration of any lease renewal option.

- Divide Step 3 by Step 4.

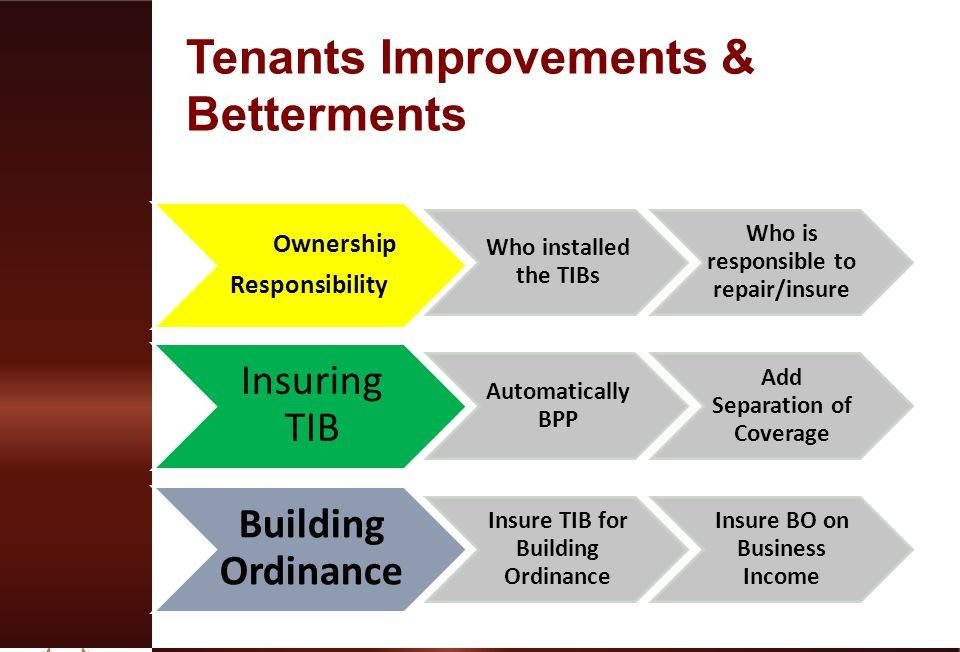

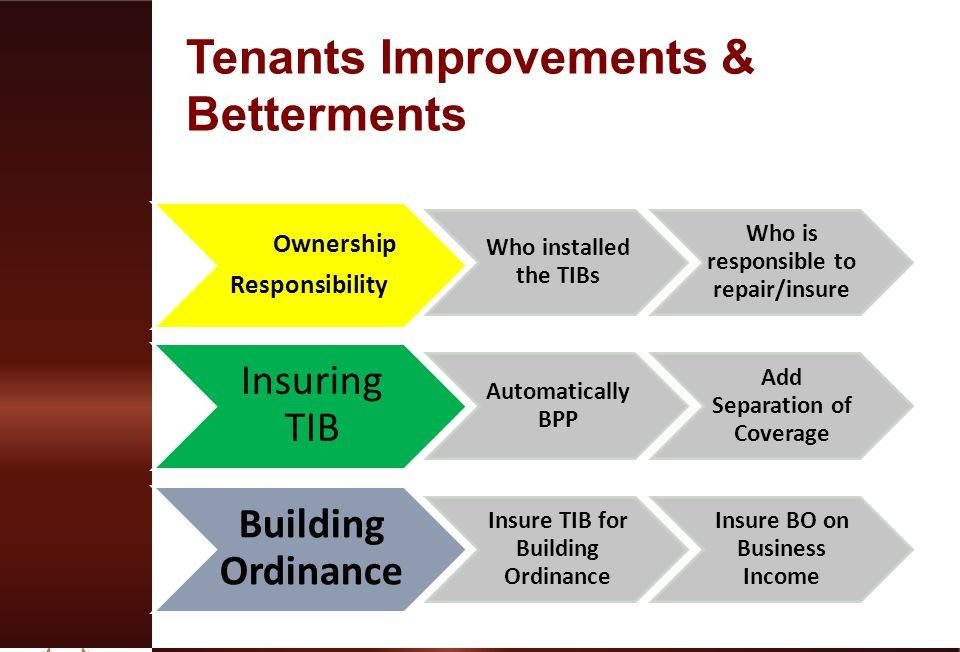

Insuring Your Improvements and Betterments

Improvements and betterments are not difficult to insure, as a building’s insurance forms automatically cover them. However, many landlords expect their tenants to insure any improvements

and betterments that are made, and some landlords refuse to increase the value of their building

policies to reflect the new value of such changes. Therefore, it is important to understand the insurance ramifications of tenants’ improvements and betterments.

Who Pays for the Insurance?

TIBs can be insured by the tenant or the landlord,

but a commercial lease should clearly state which party is responsible for providing insurance. Otherwise, disputes can arise over whose insurance (the landlord’s or the tenant’s) should apply to losses involving damaged TIBs.

policy, completed additions, and fixtures.

Suppose that the lease between Luxury Leathers and Shopping Centers, Inc., requires the landlord to insure TIBs.

Improvements made by a tenant increase the value of the landlord’s building. The value of the building will increase by $15,000 if a tenant spends $15,000 on TIBs. Otherwise, the building may be underinsured and the landlord could incur a coinsurance penalty if a loss occurs.

The tenant need not insure these items if the lease requires that the landlord must repair or replace damaged TIBs.

Example of Betterment Insurance

A restaurant leasing a building might make expensive investments in kitchen equipment, counters, and banquettes. Let’s say a pipe burst and floods the building, damaging the custom banquettes. The insurance policy held by the building’s owner would pay for structural repairs, such as a new subfloor and drywall. However, unless the owner included the cost of the upgraded dining room banquettes in

their coverage, they would not be covered. If not covered by the owner, it is the responsibility of the tenant to secure betterment insurance.

Betterment insurance is also vital in situations where the improved property remains undamaged,

but the tenant can no longer use it.

improvements and betterments

Insurance Issues and Solution

1. As a tenant, June is not providing coverage on the building. The building would be covered by the

building owner UNLESS the lease requires June to insure the building via a triple net lease or other lease transfer.

2. As a tenant, June will be purchasing TIB coverage for the June’s Crepes and Croissants under the

Business Personal Property Coverage. moreover, The Business Personal Property section includes a sub-coverage titled Tenants Improvements and Betterment. Moreover, Typical language on this policy is:

(3) Tenant’s improvements and betterments. Improvements and betterments are fixtures, alterations, installations or additions:

(a) Made a part of the building or structure you occupy but do not own; and

(b) You acquired or made at your expense but cannot legally remove.

3. The important part of this insurance statement is that June DID pay for the improvements and, therefore; insurance is clearly provided in this coverage section.

What Is a Tenant Improvement and Betterment?

Many commercial property insurance policies define tenants improvements and betterments as

fixtures, alterations, installations, or additions to a building that you occupy but don’t own. TIBs are items you’ve purchased or installed at your expense, but that you can’t legally remove.

The office, lighting, and carpeting Larry has installed in his store are TIBs. They’re now part of the building. Larry doesn’t own them, so he can’t take it with him if he moves to another location. He could damage the building if he attempted to remove them.

MORE POSTS: