securities premium reserve

Hello. Welcome to solsarin. This post is about “securities premium reserve”.

What is securities premium reserve account?

Securities premium account is a reserve account. Securities premium is the gain made by an organisation on issuing of share of a certain face value for a price higher than the said face value.

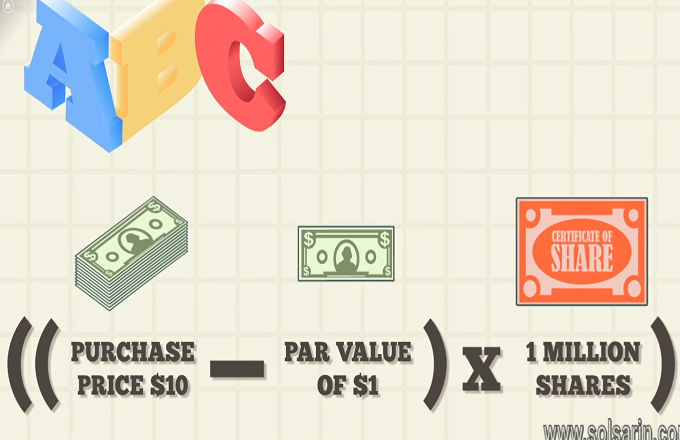

How is securities premium reserve calculated?

Share Premium Reserve Formula

(Issue price per share – Face value/par value per share) * No of shares.

OR.

Total amount received on issue of shares – Total par value of shares issued.

For example, XYZ Company issued 500 shares at $15 per share having a par value of $10 per share.

Is security premium a reserve asset?

The Companies Act 2013 states that when security premium has to be recorded in the balance sheet, it done in the Reserve & Surplus mentioned under the Equity & Liabilities of a company’s balance sheet. This item is added under the head Reserve & Surplus.

Is securities premium reserve a liability?

The premium amount is credited to a separate account called ‘Securities Premium Account’ and Is shown on the liabilities side of the company’s balance sheet under the heading ‘Reserve and Surplus’.

Where do we use security premium reserve?

According to Section 52 of the Act, securities premium can be used for the following purposes: For the issue of fully paid bonus share capital. For meeting the preliminary expenses incurred by the company. For meeting the expenses, commission or discount incurred concerning securities previously issued by the company.

Is securities premium a free reserve?

No. The capital reserves, revaluation reserves, debenture redemption reserves, securities premium and statutory reserves do not form a part of free reserves.

Can securities premium be used as working capital?

Securities premium cannot be used as working capital. According to Section 52 (2) of the Companies Act, 2013, the securities premium can be applied only for the following purposes: (i) Issuing fully paid bonus shares to the members. (ii) Writing-off the preliminary expenses of the company.

Which type of account is security premium reserve?

Answer: The account of securities premium considered as the restricted account as the amount received as the premium is not a part of free reserves. The amount of share premium account can be only utilized for the purpose as allowed in the corporate bylaws.

What are the uses of security premium reserve?

Securities premium can be used for these activities:

Issuing fully paid up bonus shares to existing shareholders.

Writing off expense of issue of shares and debentures, such as discount given on issue of shares.

Writing off preliminary expenses.

Buying back shares.

For paying premium payable on redemption of debentures.

Have you heard anything about “how much is the coca-cola brand worth?“? Click on it.

What type of account is securities premium account?

It’s also known as additional paid-in capital and can be called paid-in capital in excess of par value. This account is a statutory reserve account, one that’s non-distributable. The share premium can be money received for the sale of either common or preferred stock.

Can security premium reserve be distributed as dividend?

Amount of securities premium reserve cannot be distributed as dividend. It can only be used for the purposes listed under Section 52 of the Companies Act.

Is security premium a capital profit?

As per common sense Share premium is not ‘profit’ or ‘gain’:

Share premium is capital receipt and contributed as such by the shareholders. The amount of premium is neither ‘profit’ nor ‘gain’ of the company, it is capital receipt to be accounted for as share premium.

Is security premium part of Equity?

If debentures are issued at par but convertible at a premium, such premium will be transferred to a securities premium account. This account should be shown under the title ‘Equity and Liabilities’ of the balance sheet under the head “Reserves and Surplus”.

What is security premium in balance sheet?

Security Premium Reserve is the additional amount charged on the face value of any share when the shares are issued, redeemed, and forfeited.

Can securities premium be used to write off accumulated losses?

Writing off of Accumulated Losses does not form part of any of the aforesaid purposes.

What are the 3 types of reserves?

Reserve can be defined as the share of available profits that a firm decides to keep aside to meet unforeseen financial obligations. Reserves in accounting are of 3 types – revenue reserve, capital reserve and specific reserve.

Is OCI a free reserve?

Hence although it is a part of Net Worth as explained above, it cannot be a part of free reserves as it excludes unrealized and notional gains. Hence the amount transferred to Retained Earnings as adjustments during transition of Financial Statements from GAAP to IND AS cannot be considered as Free Reserves.

Can security premium reserve be used as working capital give reason?

Securities premium cannot be used as working capital.

According to Section 52 (2) of the Companies Act, 2013, the securities premium can be applied only for the following purposes: (i) Issuing fully paid bonus shares to the members. (ii) Writing-off the preliminary expenses of the company.

Can we use securities premium for issue of bonus shares?

As per section 52 of the Act, securities premium account can be used for the issue of fully paid-up bonus shares.

Why do companies issue shares at premium?

A company issues its shares at a premium when the price at which it sells the shares is higher than their par value. This is quite common, since the par value is typically set at a minimal value, such as $0.01 per share. The amount of the premium is the difference between the par value and the selling price.

What is a premium account?

What is a premium savings account? A premium savings account offers perks for meeting a high minimum balance requirement and/or having a relationship with the bank, meaning that you have multiple accounts with the same bank. These accounts could include bank accounts, credit cards and loans.

Can a shareholder decline a dividend?

Waiving your rights to dividends may be perfectly legal under company law, but it is caught by anti-avoidance provisions or the ‘settlement’ rules for tax purposes. A shareholder can waive his or her right to have a dividend paid to them.

Can you declare dividends but not pay?

If you have some of your tax-free personal allowances or basic rate tax band left and your company has enough profits, and for whatever reason you don’t want to pay yourself the cash dividend now, you can still declare a dividend as immediately payable and book an entry in your director’s loan account.

Do you want to know about “an empty-kcalorie food is one that contains“? Click on it.

Can a new company issue shares at premium?

All types of companies can issue their shares at premium. As per the provisions of Section 52 of the Companies Act, 2013 a company can issue shares at a premium, whether for cash or otherwise.

How do I claim old dividends?

In case outdated Dividend Warrant (DW)/Demand Draft (DD) pertaining to the relevant years is available with the shareholder, he/she can send the same to RTA with a request letter for reissue/ credit in the bank account.

What is mean by unclaimed dividend?

Unclaimed dividend is the dividend which is being paid by the company but the shareholder has not yet taken the dividend or claimed the dividend.

Unclaimed dividend is to be paid by the company as and when demanded and hence is a liability for the company.

Can we write off preliminary expenses from security premium?

Securities Premium Account can be used for writing off any preliminary expenses of the company.

To write off expenses of issue of shares and debentures,

such as commission paid or discount given on the issue of shares.

What happens to share premium on liquidation?

The company will pay corporation tax on the capital gains arising between

the sale of the assets and their market value at incorporation.

The proceeds are left in the company to reinvest or draw on as they wish, as basic rate dividends

and a personal allowance level salary to withdraw funds tax free.

Is capital and reserves profit?

The primary difference between revenue reserve and capital reserve is

that revenue reserve is the reserve which is created out of the profits of the company generated

from its operating activities during a period of time whereas the capital reserve is the reserve

which is created out of the profits of the company

What is a insurance reserve?

Insurance Reserves means any reserves, funds, or provisions for losses, claims, premiums, expenses

and other liabilities in respect of Insurance Contracts.

Is OCI taxed??

Overseas Citizens of India (OCI),

or Foreign Citizens and who are residents of India for more than 182 days have

to pay tax and file income tax return in India.

The income tax filing is usually based on his/her global income and is subject

to the conditions of DTAA (Double Tax Avoidance Agreement).