what is reenter account number

Hello dear friends, thank you for choosing us. In this post on the solsarin site, we will talk about “what is reenter account number“.

Stay with us.

Thank you for your choice.

what is reenter account number

The first person is the account holder.

Banks say few account holders have opted out of contactless.

The price varied depending on the account holder’s bank.

Banks delayed contacting account holders while waiting for the deal to clear Swiss legal hurdles.

Names of account holders will not be handed over to the British taxman.

Times, Sunday Times (2011)

The price varied depending on the account holder’s bank.

Banks delayed contacting account holders while waiting for the deal to clear Swiss legal hurdles.

Names of account holders will not be handed over to the British taxman.

They also agreed to provide debit cards to all account holders and give them full access to the main cash machine net

across Britain.

One person (account holder) runs the account.

It says responsibility for the bill remains with your ex as the named account holder, so you needn’t panic.

CUDDLE UP! A COZY QUIZ ON FALL WORDS HAS ARRIVED

Words related to reenter

How to use reenter in a sentence

The late-2017 enhancements to the policy came after Houston Texans quarterback Tom Savage was allowed to reenter a game not long after his hands could be seen shaking while he was on the ground

following a hit during a game.

The easiest solution is to leave the country for a period of time and then reenter.

Remember to wash your hands thoroughly when you reenter your apartment.

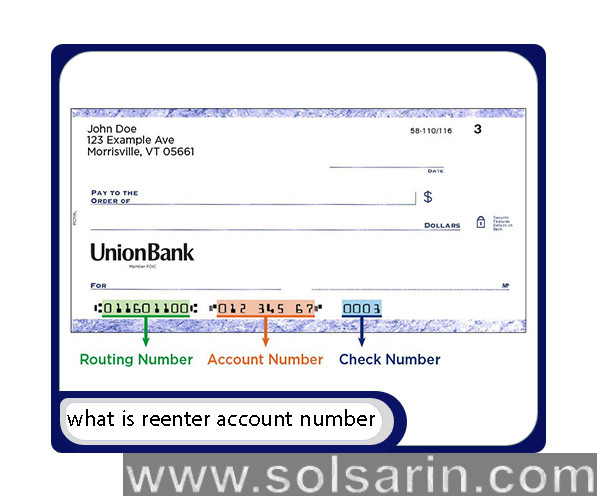

How to Find the Routing Number and Account Number on Checks

The bottom line of every bank check is preprinted with a sequence of numbers and symbols below the memo space and signature line.

These numbers and symbols aren’t random.

Rather, they contain important information that the banking system uses to process checks and transfer funds between accounts according to the instructions written on each check.

In bank parlance, this sequence of numbers and symbols is called a MICR line. Pronounced to rhyme with “snicker,”

MICR is an abbreviation for magnetic ink character recognition. MICR lines are printed in two special fonts that can be read by machines as well as people.

and are used worldwide to enable machines to read checks and reduce check fraud.

What Is a Routing Number?

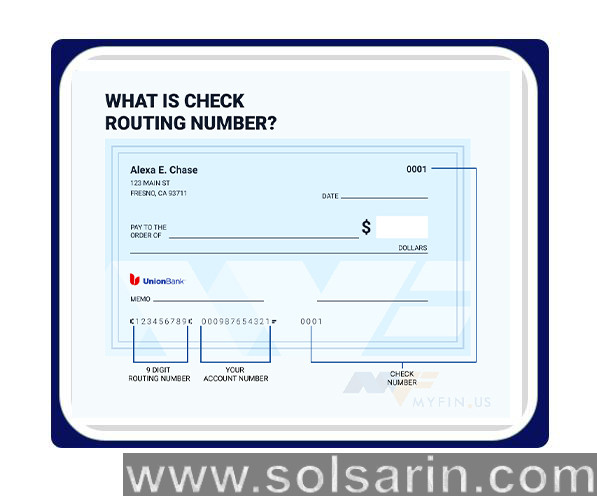

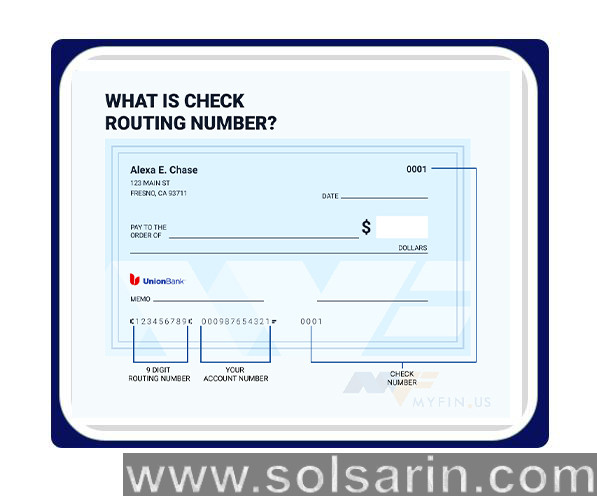

The first number in the MICR line is called the routing number.

This nine-digit number identifies the bank that’s associated with the check.

The routing number is sometimes called an ABA number – for the American Bankers Association – or routing transfer number.

What Is a Voided Check?

Banks are issued routing numbers based on the states where they operate.

That means a bank in one state will have a different routing number from the same bank in another state.

And if your bank merges with another bank, your bank’s routing number might change.

Every check that’s printed at the same bank in the same state will have the same routing number in the MICR line.

The second number in the MICR line is the account number

This number identifies the checking account that’s associated with the check. Every check for that account at that bank will have the same account number.

Account numbers are associated with accounts, not customers. If you had two checking accounts at the same bank in the same state, your checks for your accounts would have the same routing number,

but different account numbers printed in their MICR lines.

The third number in the MICR line is the check number in that checkbook for that account. This number should be identical to the check number printed in the check’s top right-hand corner.

Where Are the Routing Number and Account Number on Your Check?

Some banks may reverse the order of the account and check numbers, putting the check number second and the account number third in the sequence.

If the third number in a sequence is longer and more complex than the second number, the two numbers might be reversed.

When Do You Need Your Routing Number and Account Number?

When you write a check, you won’t need to pay much attention, if any, to your routing and account numbers.

But if you want to make a payment from your checking account without using a check, you’ll have to know your routing .

and account numbers for that account. You might also have to use these numbers to receive funds into your account or transfer funds from your account to another account.

Here are some examples of ways you might use your routing and account numbers:

- Setting up direct deposit of your paycheck or income tax refund.

- Authorizing direct payment of income tax that you owe, quarterly estimated income tax or automated direct payments, such as utility bills.

- Sending or receiving a wire transfer.

- Sending or receiving money internationally.

Where Else Can You Find Your Routing Number and Account Number?

The easiest way to find your routing and account numbers is to look at the bottom of one of your checks. These numbers are also preprinted on the deposit slips that are usually included with your checks.

If you don’t have a check or deposit slip handy, here are some other ways you can find this information:

- Call your bank. You’ll need to identify yourself to get your account number.

- Go online. Many banks post their routing numbers, by state, on their websites. To get your account number, you’ll have to log in to your bank’s website or mobile banking app.