who gets the money from tariffs

Hello dear friends, thank you for choosing us. In this post on the solsarin site, we will talk about “who gets the money from tariffs”.

Stay with us.

Thank you for your choice.’

who gets the money from tariffs

The Basics of Tariffs and Trade Barriers

International trade increases the number of goods that domestic consumers can choose from, decreases the cost of those goods through increased competition, and allows domestic industries to ship their products abroad. While all of these effects seem beneficial, free trade isn’t widely accepted as completely beneficial to all parties.

In fact, President Trump’s 2016 presidential campaign was highly critical of free trade agreements.1 In 2018.

the Trump administration introduced billions of dollars in new tariffs on Chinese imports and threatened tariffs on other countries

.2 China retaliated by announcing tariffs on U.S.

imported goods, including steel and pork.3 Trump also introduced tariffs on steel and aluminum imports from the European Union.

Mexico, and Canada in 2018.4 Later that year, China announced a 25% tariff on $16 billion worth of U.S. goods, including vehicles and crude oil.

in retaliation for the U.S. tariffs on $16 billion worth of Chinese goods. “This is tit-for-tat exactly,” Art Hogan, chief market strategist at B.

Riley FBR told CNBC. “Our $16 billion comes at a scheduled time. China said we see your $16 billion and we’ll match your $16 billion.”5

This article will examine how some countries react to a variety of factors that attempt to influence trade.

Who Collects a Tariff?

In simplest terms, a tariff is a tax. It adds to the cost borne by consumers of imported goods and is one of several trade policies that a country can enact. Tariffs are paid to the customs authority of the country imposing the tariff.

Tariffs on imports coming into the United States, for example, are collected by Customs and Border Protection, acting on behalf of the Commerce Department.6 7 In the U.K., it’s HM Revenue & Customs (HMRC) that collects the money.

It is important to recognize that the taxes owed on imports are paid by domestic consumers and not imposed directly on the foreign country’s exports.

The effect is nonetheless to make foreign products

relatively more expensive for consumers, but if manufacturers rely on imported components or other inputs in their production process, they will also pass the increased cost on to consumers.

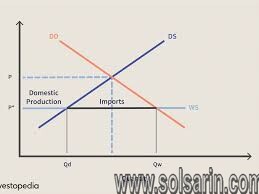

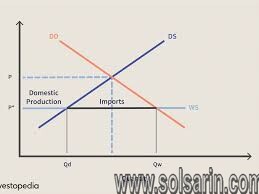

Often, goods from abroad are cheaper because they offer cheaper capital or labor costs; if those goods become more expensive, then consumers will choose the relatively costlier domestic product. Overall, consumers tend to lose out with tariffs, where the taxes are collected domestically.

Why Are Tariffs and Trade Barriers Used?

Tariffs are often created to protect infant industries and developing economies but are also used by more advanced economies with developed industries.9 10

Here are five of the top reasons tariffs are used:

Protecting Domestic Employment

The levying of tariffs is often highly politicized.

The possibility of increased competition from imported goods can threaten domestic industries. These domestic companies may fire workers or shift production abroad to cut costs.

which means higher unemployment and a less happy electorate.

The unemployment argument often shifts to domestic industries complaining about cheap foreign labor.

and how poor working conditions and lack of regulation allow foreign companies to produce goods more cheaply.

In economics, however, countries will continue to produce goods until they no longer have a comparative advantage (not to be confused with an absolute advantage).

Protecting Consumers

A government may levy a tariff on products that it feels could endanger its population.

For example, South Korea may place a tariff on imported beef from the United States if it thinks that the goods could be tainted with a disease.

Infant Industries

The use of tariffs to protect infant industries can be seen by the Import Substitution Industrialization (ISI) strategy employed by many developing nations.

The government of a developing economy will levy tariffs on imported goods in industries in which it wants to foster growth.

This increases the prices of imported goods and creates a domestic market for domestically produced goods .

while protecting those industries from being forced out by more competitive pricing. It decreases unemployment.

and allows developing countries to shift from agricultural products to finished goods.

Criticisms of this sort of protectionist strategy revolve around the cost of subsidizing the development of infant industries.

If an industry develops without competition, it could wind up producing lower quality goods,.

and the subsidies required to keep the state-backed industry afloat could sap economic growth.

etaliation

Countries may also set tariffs as a retaliation technique if they think that a trading partner has not played by the rules.

For example, if France believes that the United States has allowed its wine producers to call its domestically produced sparkling wines “Champagne”

(a name specific to the Champagne region of France) for too long, it may levy a tariff on imported meat from the United States.

If the U.S. agrees to crack down on the improper labeling, France is likely to stop its retaliation.

Specific Tariffs

This tariff can vary according to the type of goods imported. For example.

a country could levy a $15 tariff on each pair of shoes imported, but levy a $300 tariff on each computer imported.

Ad Valorem Tariffs

The phrase “ad valorem” is Latin for “according to value,” and this type of tariff is levied on a good based on a percentage of that good’s value.

An example of an ad valorem tariff would be a 15% tariff levied by Japan on U.S. automobiles.

The 15% is a price increase on the value of the automobile, so a $10,000 vehicle now costs $11,500 to Japanese consumers.

Non-Tariff Barriers to Trade

Licenses

and licenses would be granted to certain companies allowing them to act as importers.

This creates a restriction on competition and increases prices faced by consumers.

Who Benefits from Tariffs?

The benefits of tariffs are uneven.

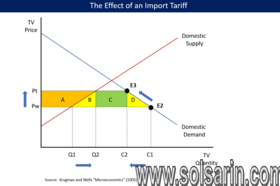

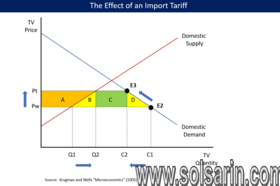

How Do Tariffs Affect Prices?

Tariffs increase the prices of imported goods

Tariffs and Modern Trade

The role tariffs play in international trade has declined in modern times.

Such organizations make it more difficult for a country to levy tariffs and taxes on imported goods, and can reduce the likelihood of retaliatory taxes.

Because of this, countries have shifted to non-tariff barriers, such as quotas and export restraints.

Tariffs also reduce efficiencies by allowing companies that would not exist in a more competitive market to remain open.

Tariff

A tariff is a tax imposed by a government of a country or of a supranational union on imports or exports of goods. Besides being a source of revenue for the government,

Etymology

The English term tariff derives from the French: tarif, lit. ‘set price’ which is itself a descendant of the Italian: tariffa, lit. ‘mandated price; schedule of taxes and customs’ which derives from Medieval Latin: tariffe, lit. ‘set price’.

Ancient Greece

In the city of Athens, the port of Piraeus enforced a system of levies to raise taxes for the city state. Grain was a key commodity that was imported through the port, and Piraeus was one of the main ports in the east Mediterranean

- RESOURCE: WIKIPEDIA