How the annual percentage rate (apr) measures the true cost of a loan?

Hello and welcome to our site solsarin. Today, we want to know more about “How the annual percentage rate (apr) measures the true cost of a loan?”. So, here we go!

Loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaying as well as to repay the principal amount borrowed.

The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower.

The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforcing by contract, which can also place the borrower under additional restrictions knowing as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent.

Acting as a provider of loans is one of the main activities of financial institutions such as banks and credit card companies. For other institutions, issuing of debt contracts such as bonds is a typical source of funding.

What is APR?

You may have seen the term APR, or annual percentage rate, used in reference to everything from mortgages and auto loans to credit cards. Understanding how banks calculate APRs and how they work can help you make more informed credit card decisions. Here’s what you need to know.

How does APR work

Generally, credit card companies offer a grace period for new purchases. If you only make purchases and pay off your ending balance each month by the due date, you pay just the amount you owe with no interest. However, if you carry a balance on your card, the agreed-upon interest is adding on to your outstanding balance at the end of each billing period.

How banks calculate APR

Though credit card APRs can vary significantly, almost all start with the U.S. Prime Rate, which is the interest rate financial institutions charge their customers for lending products. Credit card issuers add a small fee on top of that, called a margin, to the prime rate to get the APR.

That margin varies depending on the type of card, the cardholder’s credit score and how the card is used. It’s important to understand that economic conditions can cause the prime rate to fluctuate. That means APRs tied to the prime can change as well. Some banks offer fixed-rate credit cards, so the APR won’t fluctuate with changes to an index rate.

Annual Percentage Rate (APR)

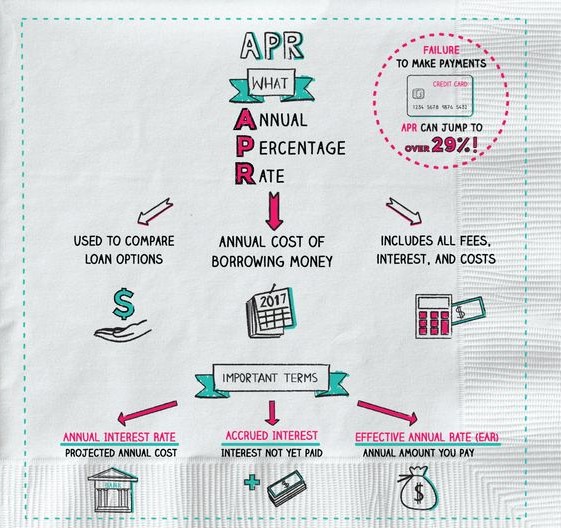

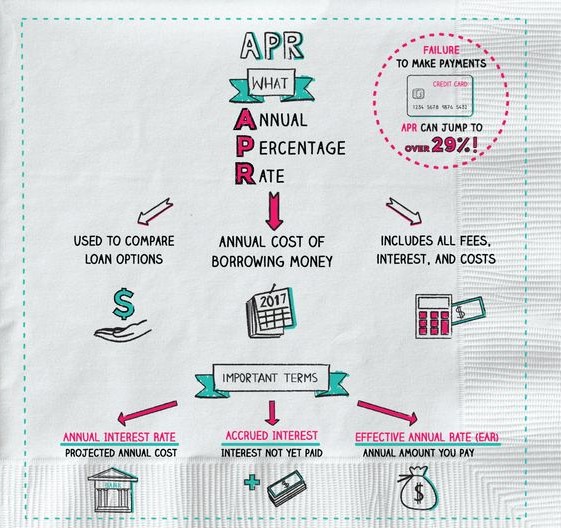

Annual percentage rate (APR) refers to the yearly interest generated by a sum that’s charging to borrowers or paid to investors. APR is expressing as a percentage that represents the actual yearly cost of funds over the term of a loan or income earned on an investment.

This includes any fees or additional costs associated with the transaction but does not take compounding into account. The APR provides consumers with a bottom-line number they can compare among lenders, credit cards, or investment products.

How the Annual Percentage Rate (APR) Works

An annual percentage rate is expressing as an interest rate. It calculates what percentage of the principal you’ll pay each year by taking things such as monthly payments into account. APR is also the annual rate of interest paying on investments without accounting for the compounding of interest within that year.

The Truth in Lending Act (TILA) of 1968 mandated that lenders disclose the APR they charge to borrowers. Credit card companies are allowing to advertise interest rates on a monthly basis, but they must clearly report the APR to customers before they sign an agreement.

How Is APR Calculated?

APR is calculated by multiplying the periodic interest rate by the number of periods in a year in which it was applied. It does not indicate how many times the rate is actually applied to the balance.

\begin{aligned} &\text{APR} = \left ( \left ( \frac{ \frac{ \text{Fees} + \text{Interest} }{ \text {Principal} } }{ n } \right ) \times 365 \right ) \times 100 \\ &\textbf{where:} \\ &\text{Interest} = \text{Total interest paid over life of the loan} \\ &\text{Principal} = \text{Loan amount} \\ &n = \text{Number of days in loan term} \\ \end{aligned}APR=((nPrincipalFees+Interest)×365)×100where:Interest=Total interest paid over life of the loanPrincipal=Loan amountn=Number of days in loan term

Types of APRs

Credit card APRs vary based on the type of charge. The credit card issuer may charge one APR for purchases, another for cash advances, and yet another for balance transfers from another card. Issuers also charge high-rate penalty APRs to customers for late payments or violating other terms of the cardholder agreement. There’s also the introductory APR—a low or 0% rate—with which many credit card companies try to entice new customers to sign up for a card.

Bank loans generally come with either fixed or variable APRs. A fixed APR loan has an interest rate that is guaranteed not to change during the life of the loan or credit facility. A variable APR loan has an interest rate that may change at any time.

The APR borrowers are charging also depends on their credit. The rates offered to those with excellent credit are significantly lower than those offered to those with bad credit.

How do annual percentage rates work?

APR is calculating considering the interests paid, the tenure of the loan taken, and other charges. In addition, they include fees, loan points, and other related charges.

How do you find the annual percentage rate?

APR can be findin with the formula, APR = ((Interest + Fees / Principal or Loan amount) / N or Number of days in loan term)) x 365 x 100.

Is the annual percentage rate the same as the interest rate?

No, APR is broader than the interest rate. Interest rates are those that have to be paid in regular monthly installments. On the other hand, APR includes interest rates, fees, loan points, brokerage, etc. Therefore, it is usually higher than the interest rates.

Why is the annual percentage rate important?

They are important as they help in knowing the cost of borrowing a loan. It can help individuals decide whether or not a particular loan is affordable for them. APR helps compare various loan options, and these underlying charges are what make loans expensive.

Mortgage APR: Why It’s More Important Than Just Looking at the Mortgage Rate

It’s time for another mortgage match-up: “Mortgage rate vs. APR.”

If you’re shopping for real estate or looking to refinance, and you’ve seen a certain mortgage rate advertised, you may have noticed a second, similar percentage adjacent to or below that interest rate, possibly in smaller, fine print.

But why? Well, one is the mortgage rate, which is the interest rate you’ll pay every month on your home loan, which dictates what your monthly payments will be.

And the other is the Annual Percentage Rate, or APR, which is the interest rate factoring in certain loan costs, such as processing, underwriting, loan origination fees, mortgage points, broker fees, and so on.

Third-party loan fees, including title insurance and appraisal fees, which are providing by vendors other than the lender, typically aren’t including in this figure.

Understanding the difference between these two figures is very important, and they will undoubtedly come up a lot as you compare mortgage loans from different lenders.

That’s assuming you actually take the time to gather more than just one quote, which you absolutely should if your goal is to save money.

Mortgage Rate vs. APR

- The APR is calculated to determine the cost of the loan

- It factors in lender fees and other closing costs

- The interest rate simply dictates how much interest you’ll pay monthly, annually, and over the life of the loan

- And is used to calculate with what your monthly payment will be

In short, the APR is a calculation used to determine the true cost of a loan, otherwise known as the cost of borrowing, represented annually.

Instead of a bank or mortgage lender telling you that your rate is 6.5% with $8,000 in fees, they’ll just say the annual percentage rate is 6.87% with those fees factored in.

The annual percentage rate was created to prevent financial institutions from not disclosing fees that went into a loan to make the rate appear better than the competition.

For example, an unscrupulous lender could advertise mortgage interest rates well below the competition while downplaying the associated fees, making their offer look unbeatable.

In reality, it could be a terrible deal once the total costs were factored in.

The APR addresses this issue by including most of the fees lenders charge during the loan transaction. These fees are then rolling into the interest rate to come up with the APR.

If you receive a loan estimate from a bank or lender, you’ll find this figure on the last page, which can be handy for comparing mortgages.

However, it’s still not sufficient to choose a mortgage based on APR alone, because lenders do not include all the fees associated with your loan transaction.

You might see something like “fees included in APR” next to the rate. Pay attention to what’s actually included. The APR also assumes a loan will be paid off at the end of the full term, whether it be 15 or 30 years.

Most homeowners hold onto their mortgages for a significantly shorter period of time, which will completely throw off the actual APR calculation.

Additionally, APR is not an effective measure between different products, only like products because of APR’s time dependency.

Random Posts

- does california tax social security benefits

- world toughest course

- steak marinade with worcestershire sauce

- can bacon be refrozen

- what year was starbucks founded

- healthy oatmeal recipes to lose weight

- what is the purpose of government

- how to measure for goalie leg pads

- what is a cash access line

- clarence thomas’s son jamal adeen thomas