who is the mortgagee?

Hi, welcome to solsarin site, in this post we want to talk about“who is the mortgagee”,

thank you for choosing us.

who is the mortgagee?

Mortgagee definition

The mortgagee is another word for the bank or lending institution providing the funds to purchase a home or refinance.

“The Mortgagee has rights to the real estate collateral associated with securitizing the loan, providing them with protection against default,” Heck says.

In other words, the mortgagee has the right to foreclose on and repossess your home if your mortgage payments go unpaid.

“These terms can be confusing because most people think of the creditor or the grantor as the institution extending something, so many believe the word ‘mortgagor’ would follow the same logic,” explains Jared Maxwell, vice president of Consumer Direct Lending at Middletown, Rhode Island-headquartered Embrace Home Loans.

Maxwell notes that the term ‘mortgagee’ appears not only in your loan documentation, but also in your homeowners insurance policy in the “mortgagee clause,” which describes the lender attached to the property.

Knowing the mortgagee definition and mortgagor definition, and understanding the roles and rights of each, makes you a more well-informed borrower when it’s time to sign your loan paperwork and other documents at closing.

In other world,

The mortgagee is the bank or lending institution offering funds to buy a home or commercial property. This may seem opposite of typical forms of “-or” and “-ee” words, such as “grantor” and “grantee,” also used in real estate. In this example, the grantor is transferring their interest in a property to someone else, while the grantee is the recipient.

Following the typical “-or” and “-ee” rules, “mortgagee” seems like a strange term for the lending institution, since they’re the giver and not the recipient of a loan. The mortgagee is receiving something, however. They acquire a claim to the property as collateral in case the borrower ever defaults on the loan. During the life of the mortgage loan, the mortgagee holds the title until the loan is paid in full. If the borrower defaults on the loan, the mortgagee may sell the property and keep the proceeds.

A bank or lender is not a mortgagee when it comes to other types of loans, however. For instance, the bank is listed as a lender for car loans, not mortgagee, because no mortgages are at stake.

Definition and Examples of Mortgagees

A mortgagee is someone who has loaned you money to purchase a piece of real estate. This is commonly a financial institution, but it can be anyone—your parents, a friend, or even a group of investors.

You’ll need to make payments on the mortgage, which usually includes a combination of both principal and interest. The mortgagee is protected against default on the loan by the ability to foreclose on the property. A foreclosure results in the entirety of the debt becoming due immediately; when it is not paid, the property can be seized and sold, allowing the mortgagee to regain their investment.

Understanding mortgagees

A mortgagee is the bank or other lender in a real estate loan – it loans money to the borrower (the mortgagor), who uses the money to purchase a home or other real estate property. While people use the terms “mortgage” and “home loan” interchangeably, a mortgage is actually a specific part of the broader home-loan process. It’s a contract that the lender and homebuyer sign, which gives the lender a stake in the property the homebuyer is purchasing as collateral for the loan. The lender/mortgagee has the right to sell the property if the borrower/mortgagor doesn’t pay back their debt.

Example

Let’s imagine a homebuyer, Joanna, who wants to purchase a new home for $500,000. Joanna can’t pay $500,000 all at once, so she goes to a bank for a home loan. As part of the loan, Joanna and the bank agree to sign a mortgage contract, which gives the bank collateral in the home – it has the right to sell Joanna’s house if she can’t pay back her loan, so it’s protected against the risk of losing the $500,000. The bank is the mortgagee, the receiver of the right to sell the collateral, and Joanna is the mortgagor, the provider of the right to sell.

How a Mortgagee Works?

Most people take out a mortgage to finance the purchase of a residence or commercial building. In order to limit its risk in the investment, the lender in the transaction creates a priority legal interest in the value of the property, substantially lowering the probability it, the mortgagee, will not be repaid in full if the borrower defaults on the loan. This is done through a perfected lien and title ownership.

Mortgage Basics

A mortgage is specifically a loan that is secured with real property or real estate. The loan agreement will lay out the number of years you have to pay back the loan, the interest rate and the payment schedule. Here are some more basic terms you’ll come across when applying for a mortgage:

Adjustable-Rate Mortgage (ARM):

Interest rates on ARMs can vary over the life of the loan. They are usually tied to an index that gauges interest rates across the world. So your interest rate may rise or dip based on several changing factors like the overall interest rate environment, the stance of the economy or the Federal Reserve’s decisions regarding interest rates.

Fixed-rate mortgage:

As the name implies, fixed-rate mortgages have a set interest rate that stays constant throughout the life of the loan. These loans offer stability and peace of mind, but may not have as low an interest rate as an ARM’s initial rate.

Mortgage preapproval:

Before a lender offers you a mortgage, it will put you through the mortgage preapproval process. This involves an extensive review of your income and credit history. After it is completed, the lender can tell you how much it’s willing to loan you.

Promissory note:

This is the legal document that details the terms of the loan and how you’ve agreed to pay it back. It also provides key information like the loan amount (principal), interest rate and date when you’re considered to be late on your payments.

Term:

A mortgage will specify the number of years you have to pay off the loan. In the U.S., the most common term is for 30 years. But mortgages for 20, 15 and even 10 years are also available. Generally, the higher the term, the lower your monthly payments —and the more interest you will pay over the life of the loan.

Protections for Mortgagees

In a mortgage loan, the mortgagee has rights to the real estate collateral associated with the loan. This provides the lender with protections against default. However, it also requires certain provisions to be made for the seizing of collateral assets if default occurs. For this reason, mortgagees include a perfected lien and integrate title rights into a mortgage lending contract.

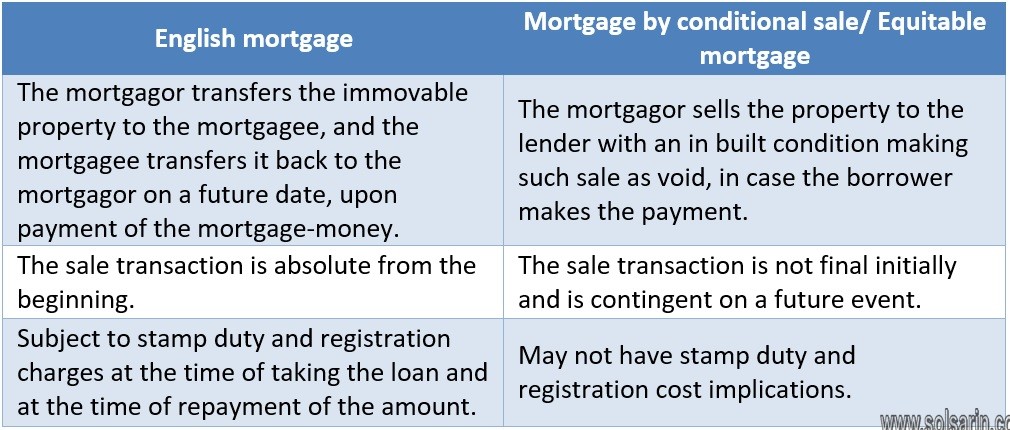

Mortgagee vs. Mortgagor

Mortgagee refers to the one who is lending the money. He is responsible for determining the terms and related clauses of the mortgage agreement. The mortgagee also needs to disclose all necessary

information to the mortgagor before signing the agreement, which also involves the terms of repayments and interest.

On the other hand, mortgagor refers to the one who is borrowing the money. He is responsible for providing all the required documents that the mortgagee needs for the agreement to push through.

For the secured loan, the mortgagor needs to declare his property as collateral, and its ownership will

be transferred to the mortgagee for the duration of the agreement or until he finished paying for the

loan and its corresponding interest payments. In general, the amount of the collateral is higher than the amount of the loan.

In case the borrower is unable to make the repayments on time, the mortgagee can sell the collateral. If it happens, the mortgagor should abide by the mortgagee’s decision.

How to get a mortgage?

Here’s a basic rundown of the steps involved with getting a mortgage when buying a home:

- Work on improving your credit score and credit history, save up enough for a minimum down payment and understand what you can afford.

- Decide on the right type of mortgage loan for you.

- Shop around with different lenders and gather mortgage offers.

- Choose a lender and loan product based on criteria important to you, such as the lowest possible rate, down payment required and loan term.

- Get preapproved for a mortgage loan and obtain a preapproval letter from the lender. Prepare to provide the necessary documentation requested.

- Hunt for the ideal home.

- When you find a property you like, make an offer and, if accepted, enter into a purchase agreement.

- Complete the mortgage loan application.

- Await an underwriting decision from the lender.

- Close on the loan and sign the necessary paperwork.

“The most important step in this process is shopping around with several lenders,

as mortgagees will compete against other offers and you may be able to lower your rate and get more favorable loan terms,” says Vance.

MORE POSTS: